Family Office

Family Offices

IBKR's lowest costs1, access to global markets, advanced trading platforms and cash management tools give portfolio managers the freedom they need to manage any family’s assets.

Discover a World of Opportunities

Invest globally in stocks, options, futures, forex bonds and funds from a single integrated account. Fund your account in multiple currencies and trade assets denominated in multiple currencies. Access market data 24 hours a day and six days a week.

Markets

Countries

Curencies

Learn More

Technology to Help Advisors Succeed

Trading Platforms

Powerful, award-winning trading platforms and tools for managing client assets. Available on desktop, mobile, web and API.

Pre-Trade Allocations

Use IBKR's pre-trade allocations to allocate block trades to multiple accounts with a single mouse click.

Order Types and Algos

90+ order types – from limit orders to complex algorithmic trading – help you execute any trading strategy.

Free Family Office Tools

Spot market opportunities, analyze results, manage your account and make informed decisions with our free tools.

Create Client-Centric Investment Portfolios

Model Marketplace

The Model Marketplace, which is a repository of model portfolios provided by third-party vendors, helps you spend more time with clients and less time managing client-specific portfolios.

Model Portfolios

Models allow Advisors to create groupings of financial instruments based on specific investment themes and invest client funds into the Model, rather than taking time to invest in multiple, single instruments.

IBKR Client Risk Profile

Use the IBKR Client Risk Profile to understand client risk tolerances and recommend suitable investments for your clients.

Environmental, Social and Governance (ESG)

ESG scores from Thomson Reuters give you and your clients a new set of tools for making investment decisions based on more than just financial factors.

Integrated Client Management

Use our free CRM to manage the full client management lifecycle, improve client engagement and improve your understanding of client needs.

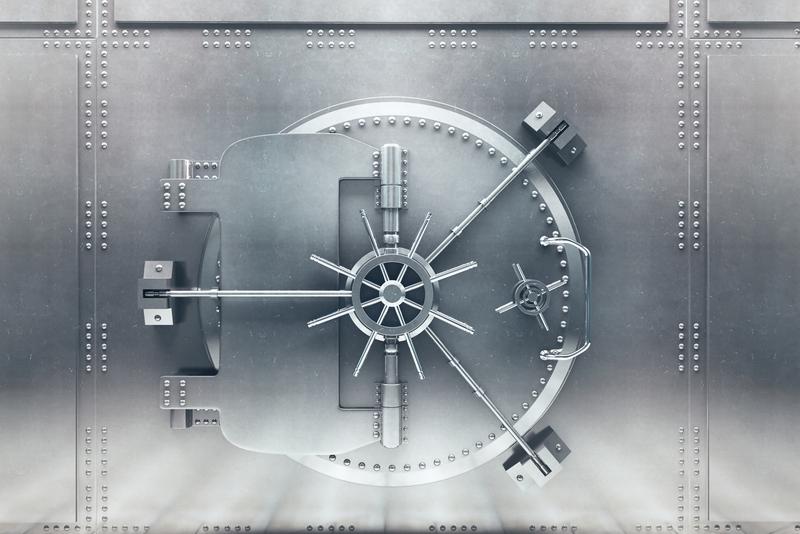

A Broker You Can Trust

When placing your money with a broker, you need to make sure your broker is secure and can endure through good and bad times. Our strong capital position, conservative balance sheet and automated risk controls protect IBKR and our clients from large trading losses.

IBKR

Nasdaq Listed

$B

Equity Capital*

%

Privately Held*

$6.0B

Excess Regulatory Capital*

Client Accounts*

Daily Avg Revenue Trades*

IBKR Protection

Family Office Account Structure

Account Structure

A master account linked to multiple client accounts.

Account Information

Manage multiple accounts of varying types under a single login, including:

Individual, Joint, Trust, IRA, UGMA/UTMA, Corporation, Partnership, Limited Liability Company, and Unincorporated Legal Structures.

Client users can optionally directly fund, view statements and trade.

Automated allocations based on pre-trade defined criteria.

Open a Family Office Account